Katsana InsightTM

Reduce Motor Claims

through Precise Behavior Data

We empower motor insurers with precise behavior patterns data and a suite of engagement tools to train drivers to become better drivers. Using a precise risk profile based on driving patterns, insurers can reward good drivers and adjust premiums accordingly, as well as identify reckless behavior before it become a loss.

Motor Vehicles Statistic

Motor Insurers making losses year after year

Top Countries

with Road Traffic Fatality

Motor vehicle accidents are one of the major causes of death globally, with rates highest in the developing world. Around our globe, an average three thousand automobile related-deaths occur each and every day

Automobile-related deaths rank as the 11th most common cause of death in developing countries, with young people in the age groups from 5 to 24 years old possessing the highest risks.

-

Dominican Republic

41.7 -

Thailand

38.1 -

Iran

34.1 -

Nigeria

33.7 -

South Africa

31.9 -

Iraq

31.5 -

Oman

30.4 -

Equador

27.0 -

Sudan

25.1 -

Malaysia

25.0

Top 10 Countries

with Highest Car Theft

If you’re talking about car thefts, the car theft capital of the world seems to change every year, with places such as Italy, France, the U.S., and Switzerland all taking top spots in the last decade according to the United Nations Office on Drugs and Crime.

Others on the list include New Zealand, England & Wales, Sweden, Australia and Denmark

-

Uruguay

502.8 -

Italy

295.1 -

Sweden

288.5 -

France

263.7 -

Greece

227.1 -

United States of America

215.8 -

Australia

212.5 -

Canada

207.8 -

Chile

185.0 -

Lebanon

179.2

Improving Driving Behavior through Gamification

We understand driving patterns, and engage with drivers

to nudge them into becoming better drivers

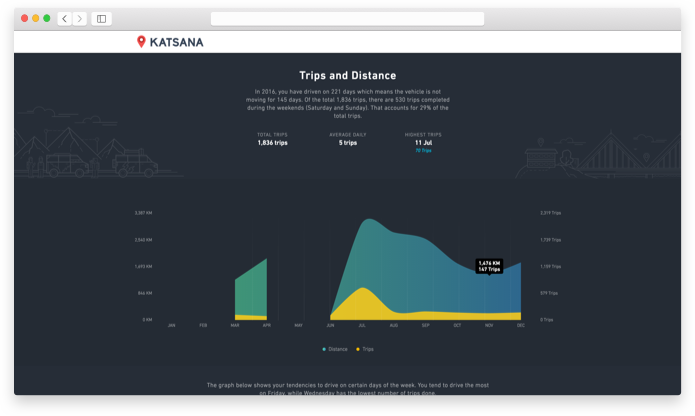

Distance Analysed

244,975,310 km

14,300,000

Location Data Daily

-62%

Risky Behaviour

Collect

Collect live telematics data through KATSANA TRACK Box or the KATSANA DRIVEMARK™ Driver App

Analyse and Score

Analyse behaviour and score the drivers and driver groups

- Evaluate, understand and reveal driving patterns.

- Profile risk pools.

- Upsell products based on location, driving style and vehicle wear and tear.

- Promote ancillary insurance products to users.

Engage and Gamify

KATSANA DRIVEMARK™ (Standalone App)

- Box equivalent data. Using phone gyroscope and GPS.

- Power efficient data transmission in data bursts.

- Engage train and challenge drivers to achieve better scores

- Continuously engage customers through food and fuel reward

Robust and cost-effective for Modern Insurers

No solution fits all. We have support for over 300 types of telematics devices plus Android & iOS SDK to allow intelligent data gathering from smartphones

Mobile Telematics App

- Highly scalable method of driving data collection with focus on improving motor owners driving behavior through gamification techniques.

- Access and analyse driving patterns of drivers beyond your pool of motor policies.

- Social elements to increase active user base that goes far beyond motor insurance and improvement of driving habit.

Secure Telematics Hardware

- Precise collection of a wealth of driving data that is temper-resistant and transmitted securely to the cloud.

- Highly secure telematics hardware that helped insurers to recover 98.2% stolen vehicles.

- Real-time tracking with unlimited log of travel history enabling insurers to provide value added service such as detection of accident and provide proactive emergency response.

Usage-based Insurance

Start reducing claims

Be amazed at the insightful data from KATSANA. Schedule for a presentation on KATSANA Insight and DriveMark solution from our experienced representative to let us understand your objectives better, and offer you with the best solution to fit your needs.